Hits: 27

原创 陈晶 投资自习室 2022-11-01 13:38 发表于浙江

These are my notes from Li Lu’s 2012 lecture at Columbia University. They’re incomplete and edited for clarity, so this shouldn’t be considered a transcript. If you have questions or comments, please reach out to me at turtlebay.io.

2012年李先生应Bruce Greenwald教授邀请,在哥伦比亚大学商学院价值投资课做了讲 座。

以下,为讲座内容大致整理,并非完整记录。

正文

It’s good to be back in Professor Greenwald’s classroom. I took his class when I was a student. His class, in fact, helped launch my investment career. So it’s an honor to come back and do this lecture. I’ve done it for twelve years, and I look forward to it every year.

很高兴再次来到Greenwald教授的课堂。我读书的时候,也上过他的课。他的课帮我开启了投资生涯。能再次回来做这次讲座,我感到很荣幸。我来这里做这样的分享,已经有12年。以后,希望每年还能来。

一、价值投资三个基本概念

I want to start by going over the three basic concepts of value investing:

- Stocks represent partial ownership in a business—they aren’t just pieces of paper;

- Investing demands a margin of safety; and

- The concept of Mr. Market.

我想先谈谈价值投资的三个基本概念:

(1)股票是生意的部分所有权,而不是交换的一张纸;

(2)投资要有安全边际;

(3)市场先生。

The first concept, stocks aren’t just pieces of paper, is easy to understand but hard to apply. When you have a piece of paper that gets quoted all the time, you tend to trade it. That’s human nature. Some people, however, view these pieces of paper as fractional interests in businesses. And those are the people we’re referring to when we talk about value investors.

第一个概念,股票不是“票”,知易行难。当股票一直被报价,你会忍不住去交易。这 是人性。但有些人,会把股票当作生意的部分股权。这些人就是我们所说的价值投资 者。

The second concept, margin of safety, is also easy to understand. Investing involves making predictions, but the future is unpredictable. No matter how smart you are, how much you know or how much work you’ve done, you’re still dealing with probabilities. The odds should be high enough so that over a lifetime you end up ahead— way ahead. But because you’re dealing with probabilities, nothing is 100% certain. You need a margin of safety to allow for mistakes and misfortune.

第二个概念,安全边际,也很容易理解。投资是对未来的预测,但未来是不可预测的。 不管你多聪明,知道的有多少,做了多少工作,投资仍然是个概率问题。投对的概率要 大,这样你最终会(大幅)跑赢。没有100%确定的事。所以,你需要有安全边际,给错误和意外灾难留出余地。

What about the third concept: Mr. Market? You’ve all heard about Ben Graham’s Mr. Market. Tell me about him.

第三个概念,市场先生,你们怎么看?你们应该都听过格雷厄姆讲的市场先生,来讲讲 你们的理解。

[Student: Mr. Market is the irrational and erratic fellow that’s always willing to trade with you.] 学生:它是一个非理性的、情绪不稳定的家伙,常想和你交易。

Right. Of course, Mr. Market is a fictional character. You can’t point to someone and say, “That’s Mr. Market.” We use him as a mental model to help ignore market noise and have confidence in our convictions.

对。当然,市场先生是一个虚构的角色。你不能当着人说,看!这就是市场先生。我们用它作为心智模型,帮助忽略市场噪音,增强信心。

It’s another concept that’s easy to understand but hard to apply. Over your career, you won’t just encounter irrational and erratic people. This business has lots of thoughtful people, too. What happens when one of them presents a well-reasoned case against you? You’ll think to yourself, “This fellow is smart, he knows more than I do and he holds the opposite view.” You end up asking, “What am I doing [betting against this person]?” That’s the more common experience, and it’s why many of you will be influenced by what others have to say.

这个概念同样理解容易,实践很难。在你的投资生涯中,你遇到的不单是非理性和情绪不稳定的人,还有很多思维缜密的 人。当他们中有人以充分的理由来反对你的观点的时候,你会怎么想?你会想:“这家伙很聪明,他比我知道得多,他的观点和我相反。”演变到最后,你会想:“我这是干什么?赌这个人讲的对不对吗?”这种情况经常发生。这就是为什么你们中的许多人,会受到其他人的影响。

Every investor must develop the frame of mind to deal with thoughtful people disagreeing with them. But how do you do this? How do you get to the point where you’re comfortable being told you’re wrong? How do you get to the point where you think it’s all noise?

每个投资者都需要培养心智,面对更聪明的人和我们观点对立。但该怎么做?怎么做才能在别人说你错的时候,还保持自在?你怎么才能知道他们说的都是噪音?

Charlie Munger has a saying: “I never allow myself to have an opinion on anything that I don’t know the other side’s argument better than they do.” What does he mean? He means you’re entitled to your opinion after reading everything you can find, talking to everyone who will talk to you and listening to all the arguments. Only then can you say, “I can hold this view because I can’t find anyone who knows more than I do.”

芒格说,如果我不能比世界上最聪明的人更能反驳这个观点,我就不配拥有这个观点!这话什么意思?芒格想表达,你需要读完所有你能找到的资料,聊完所有愿意交流的 人,听完所有的不同的意见,你才能配得上拥有一个观点。因为,这时候你能说,“这 是我的观点,我找不到比我更懂的人了。”

Let’s move on to the case studies. 接下去,我们看案例。

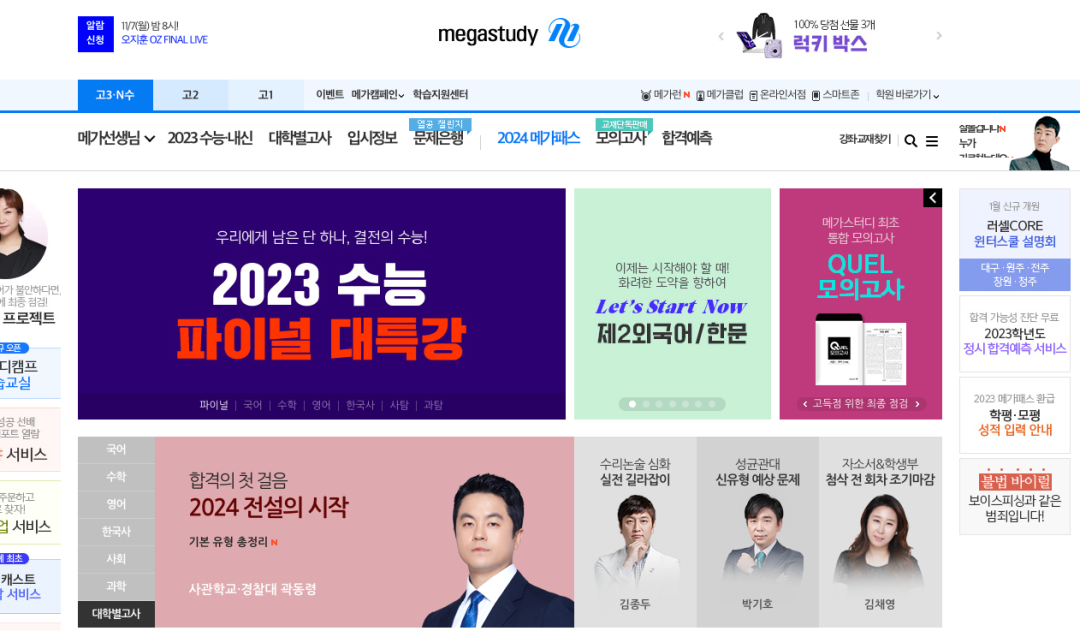

Picture the following: It’s December 2004 and a South Korean company called Megastudy is about to go public. You’ve decided to research the company as a potential investment.

2004年12月,一家韩国公司Megastudy将IPO(首次公开募股)。你准备研究这家公司, 作为潜在的投资对象。

You have the handouts with Megastudy’s information. Tell me about the company.你们手头都拿到了Megastudy的资料。告诉我这家公司是做什么的?

[Student: They provide educational services.] 学生:教育服务。

What type of educational services? 什么类型的教育服务?

[Student: They offer online tutoring services that help students prepare for the Suneung, which is the Korean college entrance exam.] 学生:在线培训教育服务,帮助学生准备韩国的高考。

Do we have any South Koreans in the room? Tell us about your college entrance exam.我们这有来自韩国的吗?讲讲韩国高考。

[Korean student: You take the Suneung in high school. It determines where you go to college.]韩国学生:高考分数决定你上哪所大学。

What about your school grades, class rank or other test scores? Do colleges look at those as well? 你的学分,班级排名和其他测试分数呢?大学也看这些吗?

[Korean student: Colleges look at your Suneung score above everything else.] 韩国学生:高考分数是决定性的。

Does the college you attend matter more in Korea than in other countries? 你上什么大学在韩国比在其他国家更重要吗?

[Korean student: Yes. A lot more.] 韩国学生:是的,重要得多。

Why? 为什么?

[Student: Your college degree determines your career prospects. You can’t get a job at a top Korean company unless you have a degree from a good school.] 学生:大学好坏决定了以后工作好坏。没有好学校的文凭,很难在头部韩国公司找到工 作。

Is it fair to say that the college entrance exam is one of the most important things a Korean will do in their life? 可不可以说高考是一个韩国人最重要的人生大事之一?

[Korean student: Yes.] 韩国学生:是的。

How do parents help their kids prepare for the test? Can they, for instance, send them to private schools? 家长是怎么帮助孩子准备考试的?比如,他们会送孩子到私立学校学习吗?

[Korean student: You can send your kids to a private school in elementary and middle school. But all students must attend the same public high schools.] 韩国学生:小学和初中可以送到私立学校,但高中必须都去公办学校。

So how do parents prepare their kids for the exam? 那家长怎么帮助孩子准备高考?

[Korean student: They send them to after-school tutors.] 韩国学生:课后补习老师。

Right. In Korea, everyone goes to tutors. And because this exam is so important, you want to go to the best tutor you can afford. But there are only so many good tutors, and their time is limited. With so much demand for their time, good tutors end up with a lot of pricing power. 对。在韩国,每个人都会去上补习。高考太重要了,所以你想要能支付得起的最好的补 课老师。但是,好老师就那么多,他们的时间也有限。需求巨大,好老师就有了议价能力。

It’s no different than someone facing a life-threatening medical condition. That person wants the best surgeon they can find. There’s a problem though: Everyone else dealing with the same life-threatening condition wants that surgeon, too. The surgeon can charge a premium, and only a few people can afford the procedure.这和看病差不多。如果一个人有生命危险,肯定想要最好的医生。问题是:其他有生命危险的人也想要同样最好的医生。这时医生就有议价,只有付得起钱的人才能获得治疗。

How does Megastudy help students prepare for the entrance exam? Megastudy是怎么帮助学生准备高考的?

[Student: Megastudy provides a platform for the best tutors to teach online classes.] 学生:做了一个在线平台,让最好的老师在上面教网课。

They hire the top teachers, tape them and put the material online. Students pay a fee that’s less than the cost of an offline tutor. Now everyone, not just the rich, can afford the best test preparation. 他们聘用了最好的老师,录课并把资料放到网上。学生们就能比线下上课少付一些钱。 这样每个人(不只是富人)能付得起最好的考前培训。

The model has caught on with customers. And it’s turned into a great business: triple-digit revenue growth, 40% operating margins, no capital requirements, etc. 这种商业模式,消费者买单,成了一门好生意:营业收入三位数增长,营业利润率 40%,轻资产等。

三、估值

KRW billions; USD millions at 1,000:1 fx rate

Year ended December 31,

| 2003 | 2002 | 2001 | ||

| Online lectures | 35 | 16 | 4 | |

| Offline lectures | 4 | 1 | – | |

| Supplies & other | 7 | 3 | 1 | |

| Total revenues ……………………………….. | 46 | 20 | 4 | |

| year-over-year | 126% | 376% | 638% | |

| Gross profit ………………………… ……….. | 30 | 14 | 3 | |

| gross margin | 66% | 67% | 66% | |

| Operating profit ……………………………….. | 20 | 9 | 1 | |

| operating margin | 45% | 46% | 30% | |

| Net profit | 15 | 7 | 1 | |

| Shares outstanding | 4.7 | 4.7 | 4.7 | |

| Net profit per share ………………………….. | 3,234 | 1,459 | 189 | |

| Return on beginning shareholders’ equity | 145% | 187% | 197% | |

| Cash | 21.7 | 11.9 | 3.4 | |

| Receivables | 0.9 | 0.6 | 0.3 | |

| Prepaid & other | 0.2 | 0.3 | 0.0 | |

| Current assets ……………………………… | 22.8 | 12.8 | 3.7 | |

| Property, plant & equipment, net | 8.2 | 0.6 | 0.1 | |

| Investments | 3.4 | 1.4 | 0.7 | |

| Other | 0.5 | 0.0 | 0.0 | |

| Total assets ………………………………… | 34.9 | 14.8 | 4.6 | |

| Payables | 0.5 | 0.6 | 0.2 | |

| Accrued & other | 7.5 | 3.5 | 0.6 | |

| Current liabilities …………………… ……… | 8.0 | 4.1 | 0.9 | |

| Long-term liabilities | 0.8 | 0.3 | 0.0 | |

| Equity | 26.0 | 10.4 | 3.6 | |

| Total liabilities & equity …………… ……… | 34.9 | 14.8 | 4.6 | |

What about the valuation?估值怎么样?

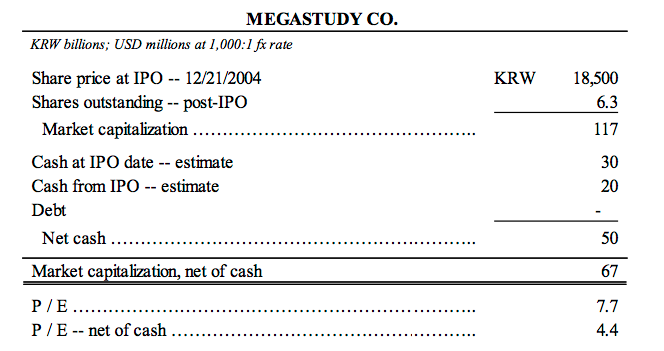

Megastudy planned on selling shares at 19,000 to 30,000 won, but the IPO priced at 18,500. They have 6.3 million shares outstanding and 50 billion won in cash (post-IPO). You can translate won to dollars at a 1,000 to 1 ratio by replacing the ‘billion’ with ‘million’. So the market capitalization is $120 million— or $70 million after netting out the cash.

Megastudy计划发行19,000股,每股30,000韩元。实际IPO发行了630,000股,每股 18,500韩元,[募集11,655百万],现金500亿韩元(IPO后)。按一美元对1000韩元的固 定汇率,市值大约1.2(1.17)亿美元,或约7千万美元(不包含现金5千万)。

How much money did they make the previous year? 上年的利润?

How much money did they make the previous year? 上年的利润?

[Student: 3,234 won per share…]学生:每股3,234韩元。

I don’t want per-share figures. Remember the first rule of value investing: A stock represents partial ownership in a business—it’s not just a piece of paper. Don’t think in ‘per-share’ terms. Give me the overall results.我不要每股的数字。还记得价值投资第一个概念:股票是生意的部分所有权,不仅是一 张纸。不要从每股这种术语去思考,给我整体的结果。

[Student: 15 billion won.] 学生:150亿韩元(1500万美元)。

Megastudy has a $120 million market value, $50 million in net cash and earnings of $15 million. That’s 8 times earnings or 4 times earnings net of cash. Remember, the $15 million in earnings was from 2003—almost a year ago. They’re growing 100% a year, but I’m not even looking at forward earnings. Megastudy市值1.2亿美元[1.17亿],5千万现金[0.5亿美金],[实际投资者0.67亿美金 可以买下整个公司],1500万美元净利润。8(1.2/0.15)倍PE,剔除现金为4(0.67/0. 15)倍PE。注意下,1500万美元净利润是2003年的,一年前的,公司的利润增速是 100%。这么低估,我都不用看2004年净利润。

KRW billions; USD millions at 1,000:1 fx rate

Share price at IPO — 12/21/2004

KRW 18,500

| Shares outstanding — post-IPO | 6.3 |

| Market capitalization ……………………………… ……….. | 117 |

| Cash at IPO date — estimate | 30 |

| Cash from IPO — estimate | 20 |

| Debt | – |

| Net cash …………………………………………………….. | 50 |

| Market capitalization, net of cash | 67 |

| P / E ………………………………………………………….. | 7.7 |

| P / E — net of cash ………………………………… ……….. | 4.4 |

What’s wrong? Why is the company so cheap? 怎么回事?为什么这个公司这么便宜?

[Student: The government released a free online tutoring service.] 学生:政府推出了免费的在线教育服务。

When was it released? 什么时候上线的?

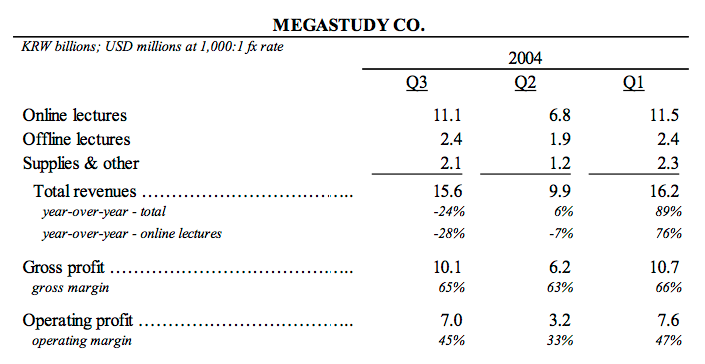

[Student: April 2004] 学生:2004年4月。In April 2004, the government released a service like Megastudy’s that students can use for free. Megastudy had been growing by over 100% per year.

How did this new free service affect Megastudy’s business? 对Megastudy有什么影响?

[Student: In the second quarter 2004, online revenues fell 7%. Then they fell 28% in the third quarter.] 学生:2004年第二季度,在线收入同比下滑了7%,第三季度同比下降28%。

We’ve discovered Mr. Market’s opposing view: Megastudy’s fee-based business model may not be viable in a market where the government offers a competing free service. Is that a realistic point of view? Yes. A thoughtful person could make a good argument, supported by the company’s recent results, that students won’t pay for online tutors when they can get them for free. And if that’s the case, Megastudy isn’t a bargain. 我们看到市场先生的相反观点:在政府推出免费课程服务后,Megastudy的收费模式可 能不成立了。真的是这样吗?确实,一个细致分析的人会用最近公司的经营数据,来支 持这个观点。有免费的用,为什么去花钱呢?如果真的是这样,那Megastudy就不是便宜股。

We’ve discovered Mr. Market’s opposing view: Megastudy’s fee-based business model may not be viable in a market where the government offers a competing free service. Is that a realistic point of view? Yes. A thoughtful person could make a good argument, supported by the company’s recent results, that students won’t pay for online tutors when they can get them for free. And if that’s the case, Megastudy isn’t a bargain. 我们看到市场先生的相反观点:在政府推出免费课程服务后,Megastudy的收费模式可 能不成立了。真的是这样吗?确实,一个细致分析的人会用最近公司的经营数据,来支 持这个观点。有免费的用,为什么去花钱呢?如果真的是这样,那Megastudy就不是便宜股。

四、竞争分析

Let’s talk more about Megastudy’s business model. How do they pay their teachers? 让我们再多讲一些Megastudy的商业模式。它怎么付钱给老师?

[Student: They charge students a fee and give the teachers a 23% commission on all the fees they generate.] 学生:它从学生那收学费,其中23%分给老师。

The government, on the other hand, pays teachers a fixed salary. It may make sense for an average teacher to switch to the government’s service. But what about the top teachers? Top teachers attract nearly all the students, and they get 23% of everything these students spend on Megastudy. Are they going to give that up for a fixed government salary? 政府是给老师固定的工资。对于一个普通的老师,有可能转到政府那去讲课。但名师 呢?名师吸引了几乎所有的学生,他们能从Megastudy赚到的钱中拿23%。

Are they going to give that up for a fixed government salary?这些老师会放 弃高薪转去赚政府的固定工资?

[Student: No.] 学生:不会。

What about the students? Why would students pay for Megastudy when they can use the government’s service for free? 学生呢?为什么能免费使用政府课程服务时,学生愿意付钱去Megastudy上课?

[Student: Exams are zero-sum, so what matters is how well you do relative to other test-takers. Koreans paid high- priced tutors for an edge in the past. They shouldn’t have a problem paying a small fee to Megastudy for that same edge in the future.] 学生:考试是零和博弈。要点是,你比其他同学考得好。之前韩国人就都愿意高价去请 私教,Megastudy收的学费更少,付钱应该问题不大。

What about new competition? What if someone started a competing service using the same commission-based model? What if someone offered teachers a higher commission? This business has 40% operating margins and doesn’t need capital—there’s lots of room to pay teachers more. Competitors could, for instance, offer teachers 33% commissions. Would that be enough to persuade the best teachers to leave Megastudy? 有新的竞争怎么办?假如有人也用同样的收费模式,但给老师更高的分层怎么办?这生 意有40%的营业利润率[operating margin],也不需要资本投入,给老师分钱的空间还 很大。比如,竞争者可以分给老师33%。这会让最好的老师离开Megastudy吗?

[Student: Teachers go where they make the most money. If Megastudy offers a lower commission but has more students, teachers will still make more money on their platform.] 学生:哪里赚钱多就去哪里。即使Megastudy的分层低,但学生多,老师总的收入还是 高的。

Correct. 33% of a small number isn’t the same as 23% of a large number. And if that’s the case, Megastudy will still attract the best teachers because they have more students.对。33%*少量学生比不上23%*大量学生。如果这成立,Megastudy因为有大量的学生, 能留住最好的老师。

Does that mean Megastudy has a network effect? Consider the dynamics: Megastudy是不是有网络效应?

…as more students use Megastudy, the tutors earn higher fees; as the tutors earn higher fees, they will continue to produce material for Megastudy; as they continue to produce material for Megastudy, more students will use Megastudy… 更多的学生用Megastudy,上面上课的老师就赚得更多。老师赚得多,他们就能持续输 出教学资料。教学资料多,学生用Megastudy就多。

If Megastudy has a network effect, how should they compete? Network-effect businesses compete in winner-take- all markets. We need to answer the question: Who will be the winner? 如果Megastudy有网络效应,会怎么竞争?有网络效应的生意里,赢家通吃。我们需要 回答的问题:谁会成为赢家?

[Student: eBay won in the online marketplace by having the most buyers and sellers? Perhaps Megastudy can win in their market by having the most students and teachers.]学生:ebay是不是,它有最多的买家和卖家用户?Megastudy是不是也会因为有最多的 老师和学生,而成为赢家。

They need to provide a platform where (a) teachers earn the most money and (b) students earn the highest exam scores. That’s the feedback loop. If they do this, pricing becomes less of an issue. 他们需要提供一个平台:(a)老师能赚最多的钱(b)学生能考最高的分。这才能形成 正向反馈。如果做到这点,价格就不是一个问题了。

What about first-mover advantage? In a network-effect business, the first to market has an advantage over everyone else. Is Megastudy the first mover in online education? 先行者有什么优势?在一个有网络效应的生意里,第一个市场进入者有领先优势。 Megastudy是第一做在线教育的吗?

[Student: Yes. The founder of Megastudy was one of the best exam teachers in the country. He knew all the other top teachers, and he offered them equity. He signed up the best teachers in every subject.]学生:是的。创始人是全国最好的老师之一。他认识其他最好的老师,给他们同样的股 权。他签约了每个学科最好的老师。[避免了烧钱竞争模式下老师的流失]

Let’s go back to our investment decision. It’s the day of Megastudy’s IPO, and you’ve reached the following conclusion about the company: they deliver an essential service; they’re the leader in a winner-take-all network- effect business; they’re growing more than 100% a year, have 40% operating margins and don’t need capital to grow; and they’re trading at 8 times earnings or 4 times earnings net of cash. But we’re still faced with one big unanswered question: Is Megastudy’s fee-based model viable when the government offers a competing free service? 让我们回到投资决策。Megastudy IPO的日子,你对这家公司的总结如下:提供基础的 服务;在赢家通吃的网络效应生意里,它是行业领导者;营收增速超100%,营业利润率 40%,成长不需要资本投入;8倍PE,剔除现金为4倍PE。 但我们还有一个问题没解答:Megastudy的收费模式到底会不会受政府免费服务的影 响?

Do you invest in December at the offering price of 18,500 or not?在12月份IPO的时候,每股18,500韩元,你买不买?

Say you decided to invest. What happens after the IPO? What happens in the fourth quarter 2004? 假设你投了。看看IPO之后发生了什么?2004年第四季度怎么样?

[Student: Online revenues increased by 15% and total revenues increased by 14%.]学生:在线收入同比上升了15%,总收入同比增加14%。

This is an improvement. Maybe we’re right that Megastudy won’t be affected by the government’s free service. Or maybe Megastudy dressed up the results to help sell the December IPO. Both are possible. 看样子我们可能是对的,Megastudy业务没受到影响。但也有可能Megastudy为了12月份 的IPO粉饰了数据。两者都有可能。

This is an improvement. Maybe we’re right that Megastudy won’t be affected by the government’s free service. Or maybe Megastudy dressed up the results to help sell the December IPO. Both are possible. 看样子我们可能是对的,Megastudy业务没受到影响。但也有可能Megastudy为了12月份 的IPO粉饰了数据。两者都有可能。

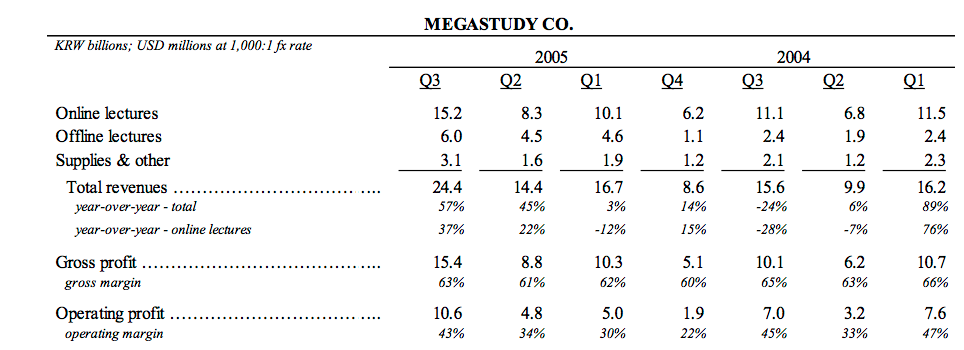

Let’s move on to 2005. What happened in the first quarter?继续看2005年,一季度发生了什么?

[Student: Online revenues were down 12% and total revenues were up 3%.] 学生:在线收入同比下降12%,总收入同比上升3%。

So what do you do? Are you wrong about Megastudy? Online revenues fell 7% and 28% in the second and third quarters, respectively. Things improved in the fourth quarter, but that could have been due to the IPO. Now revenues are down another 12%. If you believe Megastudy’s business will be unaffected by the government’s free service, how can you explain these results? 看到这你会怎么做?你是不是判断错了?2004年第二和第三季度,在线收入分别下降了 7%和28%。第四季度有所改善,但可能是IPO的原因。到了2005年,又下降了12%。如果 你认为Megastudy的业务没有被影响到,这个怎么解释?

You need to ask yourself: Do I know enough to be entitled to an opinion? Those who haven’t done the work will look at these results and think, “Maybe Mr. Market is right.” But if you’ve done the work, if you know more about the company than anyone else, if you’ve earned the right to hold an opinion, then times like these present an opportunity to act. It’s one of the defining qualities of a good investor: When the time is right, you must act. [Note: Li Lu bought more] 你得问自己:我真的配得上这个观点吗?那些没做研究的人看到这样的结果,会想“或 许市场先生这次是对的”。但如果你是做了研究,你比其他人更懂这家公司,你配得上 这个观点,这就是下注的绝佳机会。优秀投资者的一个特质:一旦时机到来,你必须行 动。

What happened next? What happened in the second quarter 2005? 接下来,2005年第二季度发生了什么?

[Student: Online revenues were up 22% and total revenues were up 45%.] 学生:在线收入上升22%,总收入上升45%。

This was an important quarter. Students are getting serious about preparing for the exam, which takes place in November. Perhaps students tried the government’s new service in the first quarter when there was still lots of time, but now it appears they’re returning to Megastudy. If that’s the case, we could be right about the viability of their business model. 这个季度至关重要。学生们开始认真备考11月份的高考。他们可能在2005年第一季度尝 试政府的免费教育服务,离考试也有很多时间。现在的情况看,他们都转向 Megastudy。你对它商业模式的判断就被验证了。

Let’s move on. What happened in the third quarter 2005?接着看,2005年第三季度发生了什么?

[Student: Online revenues increased by 37% and total revenues increased by 57%.] 学生:在线收入上升37%,总收入上升57%。

2005 2004

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |

| Online lectures | 15.2 | 8.3 | 10.1 | 6.2 | 11.1 | 6.8 | 11.5 |

| Offline lectures | 6.0 | 4.5 | 4.6 | 1.1 | 2.4 | 1.9 | 2.4 |

| Supplies & other | 3.1 | 1.6 | 1.9 | 1.2 | 2.1 | 1.2 | 2.3 |

| Total revenues ………………………… ….. | 24.4 | 14.4 | 16.7 | 8.6 | 15.6 | 9.9 | 16.2 |

| year-over-year – total | 57% | 45% | 3% | 14% | -24% | 6% | 89% |

| year-over-year – online lectures | 37% | 22% | -12% | 15% | -28% | -7% | 76% |

| Gross profit ……………………………… ….. | 15.4 | 8.8 | 10.3 | 5.1 | 10.1 | 6.2 | 10.7 |

| gross margin | 63% | 61% | 62% | 60% | 65% | 63% | 66% |

| Operating profit ……………………………….. | 10.6 | 4.8 | 5.0 | 1.9 | 7.0 | 3.2 | 7.6 |

| operating margin | 43% | 34% | 30% | 22% | 45% | 33% | 47% |

It’s becoming clear that the government’s free service won’t have a lasting impact on Megastudy’s business. Now the question becomes: Will Megastudy dominate the online-tutoring market? 事情清晰起来了,政府的免费服务不会对Megastudy业务造成持续的影响。接下来的问题是:Megastudy能占据在线教育市场吗?

[Student: It’s a winner-take-all business. Megastudy was the first mover and has a big lead. They have a good chance of dominating their market.] 学生:既然是赢家通吃的生意,它又是先行者,有很大领先优势,很有机会占领这个市 场。

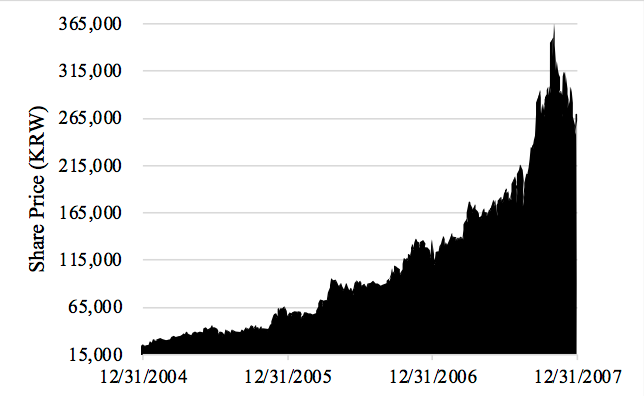

Over the next few years, Megastudy did indeed dominate Korea’s online-tutoring market: they overcame the threat of both new entrants and the government’s free service; they reached 80% subscriber market share and had revenues 6 times larger than their nearest competitor; and they grew 50% a year and maintained 35% operating margins. No one else came close. 接下来的几年,Megastudy确实占据了韩国的在线教育市场:他们战胜了新进入者和政 府的免费服务;占80%订阅市场份额,营业收入是第二名的6倍;50%的增速,保持35%营 业利润率。遥遥领先了。

CAGR Year ended December 31,

| (2007-2004) | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | ||

| Online lectures | 41% | 99 | 59 | 44 | 36 | 35 | 16 | 4 | |

| Offline lectures | 78% | 44 | 31 | 19 | 8 | 4 | 1 | – | |

| Supplies & other | 43% | 20 | 12 | 9 | 7 | 7 | 3 | 1 | |

| Total revenues ……………………………….. | 48% | 163 | 101 | 71 | 50 | 46 | 20 | 4 | |

| year-over-year | 61% | 43% | 41% | 9% | 126% | 376% | 638% | ||

| Gross profit ………………………… ……….. | 47% | 102 | 63 | 44 | 32 | 30 | 14 | 3 | |

| gross margin | 63% | 62% | 62% | 64% | 66% | 67% | 66% | ||

| Operating profit ……………………………….. | 43% | 58 | 32 | 25 | 20 | 20 | 9 | 1 | |

| operating margin | 36% | 32% | 35% | 39% | 45% | 46% | 30% | ||

| Net profit | 46% | 46 | 26 | 21 | 15 | 15 | 7 | 1 | |

| Shares outstanding | 10% | 6.3 | 6.3 | 6.1 | 4.8 | 4.7 | 4.7 | 4.7 | |

| Net profit per share ………………………….. | 33% | 7,290 | 4,345 | 3,464 | 3,115 | 3,234 | 1,459 | 189 | |

| Dividends per share ………………………….. | – | 1,800 | 900 | 750 | – | – | – | – | |

| payout ratio | 25% | 21% | 22% | – | – | – | – | ||

| Return on beginning shareholders’ equity | 40% | 29% | 32% | 57% | 145% | 187% | 197% | ||

| Cash | 63.0 | 60.7 | 50.6 | 52.7 | 21.7 | 11.9 | 3.4 | ||

| Receivables | 7.7 | 4.3 | 2.1 | 1.5 | 0.9 | 0.6 | 0.3 | ||

| Prepaid & other | 11.1 | 8.2 | 4.4 | 1.8 | 0.2 | 0.3 | 0.0 | ||

| Current assets ……………………… …………………… | 81.8 | 73.1 | 57.1 | 56.1 | 22.8 | 12.8 | 3.7 | ||

| Property, plant & equipment, net | 47.4 | 30.7 | 23.7 | 8.7 | 8.2 | 0.6 | 0.1 | ||

| Investments | 68.7 | 39.0 | 23.9 | 8.2 | 3.4 | 1.4 | 0.7 | ||

| Other | 8.1 | 0.7 | 0.5 | 0.6 | 0.5 | 0.0 | 0.0 | ||

| Total assets ………………………… …………………… | 206.0 | 143.4 | 105.2 | 73.6 | 34.9 | 14.8 | 4.6 | ||

| Payables | 3.4 | 1.7 | 1.1 | 0.6 | 0.5 | 0.6 | 0.2 | ||

| Accrued & other | 38.7 | 20.7 | 11.2 | 7.3 | 7.5 | 3.5 | 0.6 | ||

| Current liabilities …………………… …………………… | 42.2 | 22.4 | 12.3 | 7.9 | 8.0 | 4.1 | 0.9 | ||

| Long-term liabilities | 2.8 | 5.7 | 2.4 | 0.6 | 0.8 | 0.3 | 0.0 | ||

| Equity | 161.0 | 115.4 | 90.5 | 65.1 | 26.0 | 10.4 | 3.6 | ||

| Total liabilities & equity …………… …………………… | 206.0 | 143.4 | 105.2 | 73.6 | 34.9 | 14.8 | 4.6 | ||

[Student: What about the stock price?] 学生:股价怎么样?

The stock went up more than 10 times. But a stock that rises like that presents a new set of issues. When Megastudy went public, investors were paying $70 million for $15 million in earnings. Now investors are paying $1.5 billion for $50 million in earnings. 涨了10倍多。上市时,投资者是花7000万美元[0.67亿美金],买了1500万美元净利润。现在要花15亿美元,买5000万美元净利润。

You need to ask yourself: Do I still have a margin of safety? Is this stock still a bargain? Are there better uses for my capital?你要问自己:我还有安全边际吗?这支股票 还是便宜吗?我这些钱有更好的去处吗?

[Student: What about saturation? Korea isn’t a big market, so how much longer can they grow 50% a year?] 学生:市场会饱和吗?韩国不是一个大市场,他们每年增长50%能保持多久?

[Student: What about saturation? Korea isn’t a big market, so how much longer can they grow 50% a year?] 学生:市场会饱和吗?韩国不是一个大市场,他们每年增长50%能保持多久?

That’s another question you need to ask. Megastudy started when online was 1% of the overall tutoring market. You can grow a lot if you start from a low base—even in a small country. But what about when everyone uses online tutors and you control 80% of the market? Will Korea’s tutoring market continue to grow? Will students continue to move from offline to online? Will Megastudy continue to take market share? And do I know enough about these things to pay 30 times earnings? 这是另外一个你需要去弄清楚的问题。Megastudy刚开始的时候,在线教育在整个教育 培训市场的渗透率只有1%。从低基数开始,即使是在一个小国家,你也能成长很多。但 如果情况是每个人都上网课,你的市占率达到了80%呢?韩国的教育培训市场还会继续 扩大吗?学生还会继续从线下转到线上吗?Megastudy还能扩张市场份额吗?关于这些 问题,我知道足够的东西,为30倍PE买单吗?

We don’t have time to answer these questions today. I’m focused on Megastudy’s IPO because I want you to see that you can find bargains in all kinds of places, including IPOs. But I suggest you study what happened to Megastudy and answer some of these questions for yourself. It’s another good case study. 今天,我们没有很多时间回答这些问题。我重点讲Megastudy IPO阶段,因为我想让大 家看到,你可以从任何地方找到便宜股,包括IPO。但我建议你继续研究Megastudy,并 自己回答上述的问题。这会是另一个好的案例。

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023

粤ICP备2022015479号-1 All Rights Reserved © 2017-2023